For Q4CY22, Raghav and I optimised for (i) distance-travelled 🏃🏻♀️ w.r.t. our understanding of the API Ecosystem (ii) improving our collaboration output iteratively - few sprints at a time.

To increase the distance-travelled, we adopted a ‘zoom-in; zoom-out’ approach (akin to toggling a 📸 camera to focus better).

To zoom-out, we attempted to iterate on our API Ecosystem Landscape Framework from post #3 . A cumbersome goal as APIs are omnipresent building blocks for all software applications. We did this by (a) exploring API centric/adjacent areas such as AI LLM’s proliferation, modern data stack tooling (b) identifying key distribution (aka GTM) strategies (c) interacting with a handful of young developers & software investors. On the other hand, we decided to zoom-in: picked a niche problem and built a quick MVP solution. Here, the objective was to get our hands-dirty with quick execution to (i) gauge build complexity (ii) unearth unknown unknowns.

1️⃣ ZOOM IN 🔎

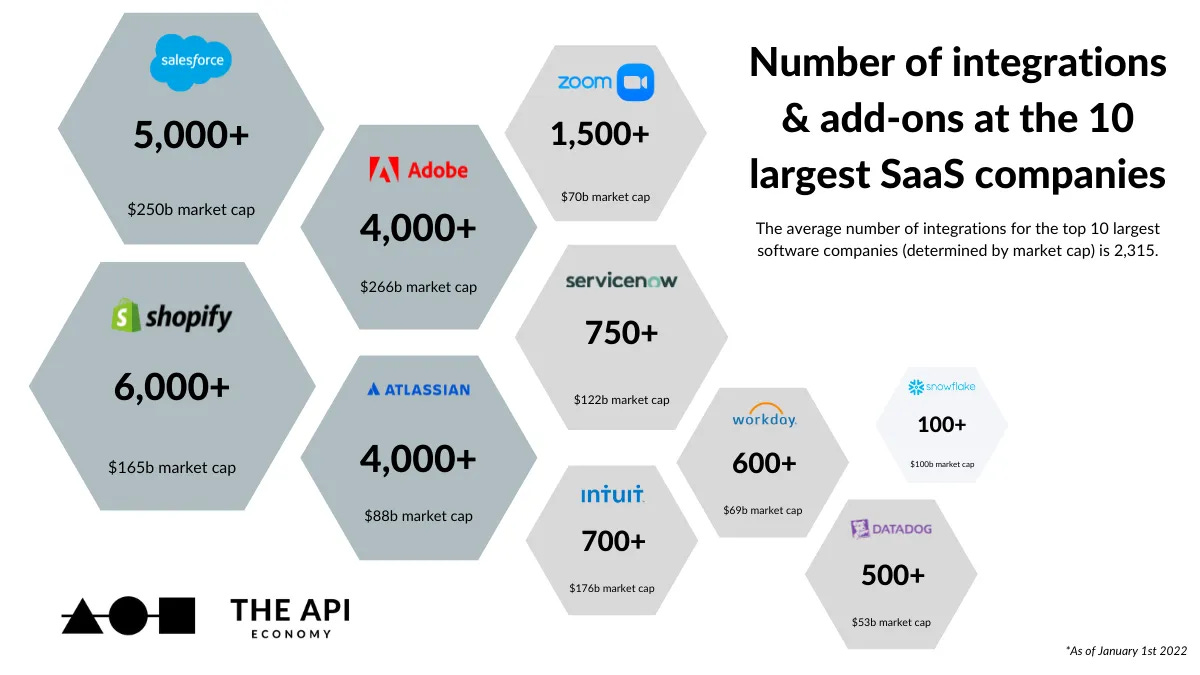

There is a steady trend, for large companies such as Salesforce, Snowflake, Slack, MS, Workday (and many more), to morph into platforms more than silo-ed products i.e. exposing their data and functionality as APIs for others to build on. Most new (~2-3 years old) B2B software startups, have been leveraging existing system of records (in most sub-verticals such as CRM, HR, Accounting, Ticketing, Data Warehouses, Social Media etc.) to build the next iteration of useful tooling, workflows, automations and analytics.

If you spend a day looking at a new SaaS company in most verticals such as Sales/RevOps, FinOps Engineering Analytics, Data Observability, Product Management, Compliance, Productivity Tools, HR etc. you will notice a common key feature → ⛓ INTEGRATIONS ⛓

So for our quick MVP build, we decided to create a unified API product ⭐️, which eliminates the need for new B2B software companies to build & maintain multiple integrations ⛓. Instead, developers and/or product managers, at these B2B software companies, can integrate with our MVP once and expose all out-of-box integrations to their end user. Without geeking-out on the ROI math, please assume there is an explicit speed and monetary advantage to buy over build here (esp. in countries where developer salaries are high) . On the flip side, this article highlights specific pitfalls of employing Unified APIs.

🏗 So, we built a unified API i.e. unified data schema for the TICKETING vertical on top of platforms such as Github Issues, Jira, Trello, Asana etc. Find below screenshots of the product flow and some commentary.

🎯 Pretty neat solution!! So, it should not be surprising if there are a few VC-backed companies already rallying to solve this. In our opinion, the first-mover has a ~20 months head-start. Below is a list of notable startups:

Merge.Dev | Series B US$75M raised from Accel, NEA, Addition

Paragon | Series A US$20M raised from Inspired, YC, VillageGlobal

Pandium | Seed US$2M

Hotglue | Perhaps bootstrapped

Alloy | Series A US$27M from a16z, Bain | Ecommerce Vertical Focus

Workflow automation cos. such Workato, Tray are also piling-in.

But this has not stopped nifty entrepreneurs, in the past, to jump in late. One can argue there are areas to differentiate such as verticals, geographies, sales motion, product advancements etc.

Further, for a 360° view, we attempted napkin math 🧮 on one of the companies, Merge.Dev, to gauge its revenue build-up, scale, valuation below →

Alternative Way to Skin the Cat 🐱: Merge raised US$55M as Series B in Oct’22. Conventionally (we always have edge cases), hot software startups raise Series B when their Exit ARR is ~$7-10M. We can assume,Merge.dev was at ~US$8M Exit ARR.

Going further under the hood, guidance for hot early stage software startups is to grow at least 2x-3x YoY. So NTM Revenue projections should be ~US$16M. The average for Top 10 EV / NTM Revenue Multiples for large public software companies was ~16x at the time. Assume Merge.dev got ~20x multiple, one can assume Series B valuation of ~US$320M. Leaving management (including ESOPs) with 40-50% ownership.

🏗 This quick build was an eye-opener for us. We uncovered the trickier aspects of scaling up the MVP: privacy & security of data and platform scalability i.e. adding and maintaining integrations. Further, we saw similarities in the engineering architecture of Data pipelines/ETL companies such as FiveTran, Hevo, SuperMetrics. Additionally, we explored GraphQL as a standard opposed to REST APIs. Overall, we rate our MVP’s build complexity as moderate and feel this solution will continue to get more commoditised and GTM will determine success for contenders..

2️⃣ ZOOM OUT 🗺

In post #3 (please re-view the main image), we shared the API Ecosystem Landscape v0.0.1 😇 . The more we tinkered (zoomed-in above), demo-ed companies, researched and collected feedback, the more we felt the urge to iterate over the first version. Most material update is a subtle one: it is to view the API Ecosystem Landscape from a Traditional Value Chain perspective.

We believe this representation can be refuted. However, at this juncture, we feel comfortable with this view to move ahead with our broader goal of iteratively tinker in adjacent niches. Subject to a pivot, our instincts tell us to double-down on ⛓Connectivity Fabric ⛓ theme.

Our 1️⃣ sub-theme was Integrations as-a-service (zoomed-in above) and we are tinkering with the 2️⃣ sub-theme at the moment. More action to follow.