🔩Low-Code Automation

Overall Framework with a Double Click on Workflow + Integration Automation.

Rabbit Hole #1️⃣

Workflow & Integration Automation Software: Zapier (incorporated over a decade ago), Alloy (a16z funded in 2021 boom year) and Merge.dev were first few companies that piqued my interests. These shops give some flavor of the landscape but they are small piece of a vast, ongoing & crowded puzzle = Process Automation. There is a growing ecosystem of tools for automating everything from simple repetitive tasks to complex custom workflows.

First, let’s share an overall framework of Automation Software [Process].

↘️TOP-DOWN → Narrowing Scope using Framework

“Mapping the automation software space requires a much more holistic approach than simply identifying the nascent players with next-generation solutions”

Let’s start with Automation in general. This article by OpenOcean does a good job at making the overall Automation [much broader framework than what this articles covers below] landscape digestible. The snapshot image in the article gives a great view on the overall Automation landscape spanning legacy IT services, end to end legacy RPA/BPM players to OSS companies. A quick must see before moving forward.

Moving forward, the article focuses on Process Automation and Camunda’s founder has already done the heavy lifting so it’s best to borrow. I found his slicing-dicing particularly useful as a “Mental Model”. So lets start with his framework →

Tailor-made processes involve building software for process automation. This is “software to build software” and can be roughly categorized as follows->

1️⃣Developer-friendly tools integrate frictionlessly in typical developer tool stacks and journeys, but solve certain problems for the developer that are specific for process automation (e.g. providing persistence of the process state, graphical process models, versioning of process models on Camunda/Google Workflow/AWS Step). Developer-friendly tools require software development to build a solution.

2️⃣Low-code tools allow non-developers (and in some cases highly self serve to developer / citizen devs) to implement automation logic by providing sophisticated graphical user interfaces and wizards, hiding some/most technical details. This allows different roles to build solutions, but also arguably limits possibilities and requires proprietary know-how.

🚨This rest of the article limits the scope to 2️⃣LOW-CODE TOOLS. The table below further bifurcates this space and narrows the focus.

↗️BOTTOM-UP→ iPaaS and Workflow Automation Companies

Workflow automation tools, sometimes known as integration platform-as-a-service (iPaaS), have been around for a while (think Mulesoft and Boomi). The most recent tools (Workato, Zapier, Tray) blend a heavy mix of 🎯 low-code workflow builders that are accessible to a broader range of developers and end users. The primary use case of workflow automation tools is to integrate into many different tools (say CRM, messaging, and your product) and tie these integration steps together in an event-driven workflow. Common use cases include data migration, HR automation, sales automation, and marketing automation. Workflow automation tools have expanded their capabilities over time to also include ‘embedded’ and ‘unified API’ scenarios where an end customer of an application can customize their own integration flow within a product.

The Landscape below is of Low-Code Workflow / iPaaS Automation tools mostly. These are mostly venture-backed companies funded in the last 10 years. The split below helps understand bifurcation of companies under this niche. There is also a slew of large platform companies with similar tools offered as a feature offering such as Amazon AppFlow, Shopify Flow, MS PowerAutomate, Mulesoft, Airtable. These bundled softwares have been excluded on purpose.

A good way to utilize the landscape is to look up each company and decide what would be the correct classification for it.

🍒CHERRY-PICKING A FEW LOW-CODE ENTRANTS

#1 Alloy: Today, the modern ecommerce stack [think of apps built on Shopify platform; they generated $12.5 billion in revenue] introduce a tremendous manual process burden for the merchants. Horizontal orchestrators like Zapier are brilliant for automating data/ triggers between these apps, but lack coverage for the long tail of specialized processes. Founders at Alloy want to go to every end point and every depth of an ecommerce business such as time based triggers and specific conditional statements that Zapier.

On the UI/UX front, its a marriage between Zapier [and IFTTT Type] of Conditional Blocks] and Workato [Horizontal Workflow/Process Interface]. Alloy prices its self serve product at US$50 per month for small businesses and Custom pricing for larger ecommerce clients such as Doe Lashes, BOKKSU, Denver Broncos. Its safe to assume they will be close to exit ARR of US$800K-$1.5M in the H12022.

Not surprisingly, the company has recently forayed [in 2022 summer] into embedded iPaaS [Tray.io made a similar move sometime back] offering with both internal and external facing apps for SaaS clients. Going by their website, they will definitely leverage ecommerce domain expertise, build and target customers methodically.

#2 Merge.dev: This company tilts more in developer-friendly tool but the product’s claim on (i) time-to-value and (ii) 10x better self-serve warrants a classification in the scope of low code iPaaS tools. The founders [Columbia University batchmates] were working in separate tech organizations facing similar issues with embedding customer facing integrations in B2B SaaS offerings i.e. “Software engineers were required to build out each integration and deal with the numerous complexities introduced by varying data models and protocols across APIs” According to them, the pain point was not being addressed by incumbents efficiently [think Tray.io, Workato although both entities have moved into building similar solutions]. So, in response, the duo decided to build 10x better iPaaS Universal UPI centric company catering to B2B cloud-native software that no longer need to worry about things like normalizing data, monitoring changes, and making updates to individual integrations when providers update and change their APIs.

From Day 1 the company is building for enterprise-level scale. They received SOC2 Type II certification right out of the gate, and have prioritized security from the beginning in order to offer an enterprise-ready solution. Over the course of 18 months, they have built and scaled universal APIs for HRIS, ATS, Payroll, ticketing and Accounting integrations for 800+ customers [eg: Agora, Opal, Drata] representing ~$1-2M in Exit ARR. Lastly, their documentation, contextual demo/onboarding and content is quite crisp! [Direct Competitor in HRIS space → Finch]

#3 Bardeen.ai was conceptualized on the premise that most of the work happens on the 💻browser today. Therefore, the automation should happen there instead of the backend. This is a starkly different product [from the other 2 mentioned above] as in it caters to ‘bottoms-up’ 20-35 year old productivity knowledge users from varied industries with a keen focus on UI/UX. The founders come with a stellar pedigree (ex CERN Software Engineer) and this would be major contributor for the back-to-back sizable fundraise from marquee VCs.

The key NO-CODE automations features are in domains of (i) Data Research [mostly scraping info and gathering in databases eg: LinkedIn Candidate HR sourcing to Notion] (ii) Product Development [Trigger based mini automations to update eg: Email to Jira] (iii) Contextual Automation i.e. browser extension learns from your repetitive tasks and recommends micro automations to save time. Although this feature, I reckon, is in its infancy at the moment.

The strategy for the company is to enter as a free tool → Grab market share by adding more collaborative features into the product → Understand user wants/needs better → Eventually go B2C2B for monetizing. The grand vision would be to “automate the automations” i.e. contextual AI feature in hyper-mode. With the ever expanding universe of 4000+ SaaS application, seamless contextual in-browser automation could be a real solution to save time working on all SaaS apps. As long as they create micro automations for apps that are used ubiquitously and keep the automation simple yet useful, Bardeen.ai will stay relevant. But this is a tough space for monetization i.e. selling to end consumers. Further, there is much competition approaching the problem [or at least part of it]. Bardeen needs to really showcase that contextual AI feature works like magic for a broad set of users and saves real time for them.

🌏Indian Players

We see a fairly nascent ecosystem in India w.r.t. low-code integration/workflow automation companies. Majority set-up shop in the last 1-2 years. We also saw 2 acquisitions in 2021 - (i) Automate.io acquired by Notion (ii) RailsData acquired by Workato.

Further, we have bunch of general automation platforms such as Kissflow, Jiffy.ai with scale but these are slightly broader in scope relative to companies in this article. Further, some consultants like TCS even offer their own automation software alongside services, like TCS’ MFDM platform, while others, such as NTT-AT or TechMahindra are both consultants and platforms. These process automation services, which sprung out of the decades-old business process outsourcing and management space, must be mapped against the newer, product-first automation startups to give full context to the broader automation software landscape. Lastly, Yellow.ai and GupShup also could be under purview. These companies started as messaging AI platforms moving into broader adjacent workflow automation.

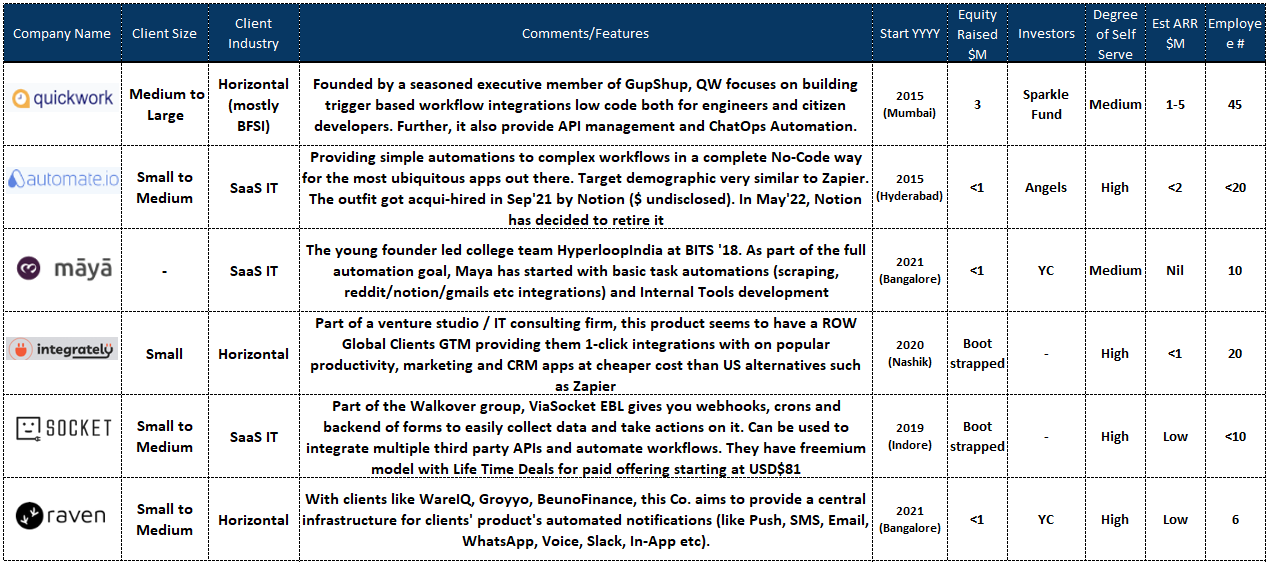

Below, you will find a quick overview of companies operating the low-code workflow automation space [we do not have many on the Infra/iPaaS space]. Some of them serve to Indian clients such as Quickworks and some them are playing cost arbitrage play with global clients [think Integrately vs. Zapier]. RavenApp.dev stands out for its niche focus on automation for notifications infrastructure in a self-serve manner.

🔮Takeaways

Orchestrating how modern software interoperates has the power to change how modern business runs. SAP expected to automate processes running across SAP’s ERP, CRM, and SCM offerings. Reality is different: front-to-back SAP shops are rare. Companies are instead combining best of breed apps with custom tools to solve their needs. Noticing the trend, vendors are investing in the process layer (Salesforce acq. MuleSoft, SAP acq. Contextor, Microsoft acq. Softomotive) to avoid being modularized and abstracted away.

Today, companies are no longer differentiated by apps they purchase. CRMs, ERPs, and other apps are table stakes. What sets companies apart today is how they make apps work for them. In a very broad sense, Enterprise Automation opportunity is north of ~$100 Billion. Within this space, the industry has witnessed a couple of waves i.e. RPA / BPM → stand alone orchestration services and apps → low-code / no-code solutions leveraging AI/ML. Within the low-code solutions, the bouquet of aforementioned companies, in this article, is estimated to have cumulate market revenues of ~$1-3 Billion with rapid growth rates i.e. most of them recorded 2x growth in last 12 months.

Consolidated view of technical pundits → Low-code task automation tools [up until now] are great for solving simple integration problems in isolation and help to remove manual integration work, such as copying data over from system A to system B. Some of these tools can really help to automate simple processes. If you are a startup, you might get along with a typical set of SaaS applications and then connect them using iPaaS solutions sufficiently. But these approaches fall short on complex business processes or integration scenarios.

The new slew of startups are addressing these issues head-on as follows (no exhaustive) →

1️⃣ Verticalization in Process Automation whether by industry or specific functions: Today, companies such as Alloy [detailed above] and Sora are building for larger outcomes as market sizes in each vertical are expanding as companies seek the benefits of automation in more processes. They can further deepen their value by tapping into various AI services, like IBM Watson, Salesforce Einstein, Google Vision, and helps create better automations by default via recommendations [think Bardeen.ai] going beyond administrative ease.

2️⃣ More Robust and Automatic APIs - Even though embedded workflow automation [like Tray.io and Workato] requires less engineering, companies are still required to maintain thousands of workflows for APIs that break, change, and add functionality over time. Companies like Merge.dev understand the value gap and offer universal/unified APIs. if you’re building a B2B product and need to add at least several integrations, the unified API will do the heavy lifting of understanding the different schemas, authentication, pagination, and any other quirks that a platform will have. They’ve built a layer of abstraction on top of all kinds of APIs out there.

Lastly, The market opportunity is compelling across geographies [not just the US market] as in regions such as India, SEA. An automated process layer is next logical unlock as software adoption deepens.

#55